Optionality is the free will, not obligation, to choose from two or more choices. With optionality, the idea is to have more options with low cost, but unlimited upside.

Morgan Housel, in his book The Psychology of Money, mentions Tail Events which have a strong correlation to optionality. He presents the example of Walt Disney who had produced several hundred hours of film across multiple projects by the mid-1930s. Almost all were losing money until Snow White and the Seven Dwarfs changed everything. The $8 million it earned in the first six months of 1938 was an order of magnitude higher than anything the studio earned previously. Disney kept trying new things despite the fact that he knew almost all of them would fail; he only needed to succeed one, though, to make up for all of his other losses. That’s Tail Events, the highly profitable, huge, or influential outcomes from a series of failed attempts.

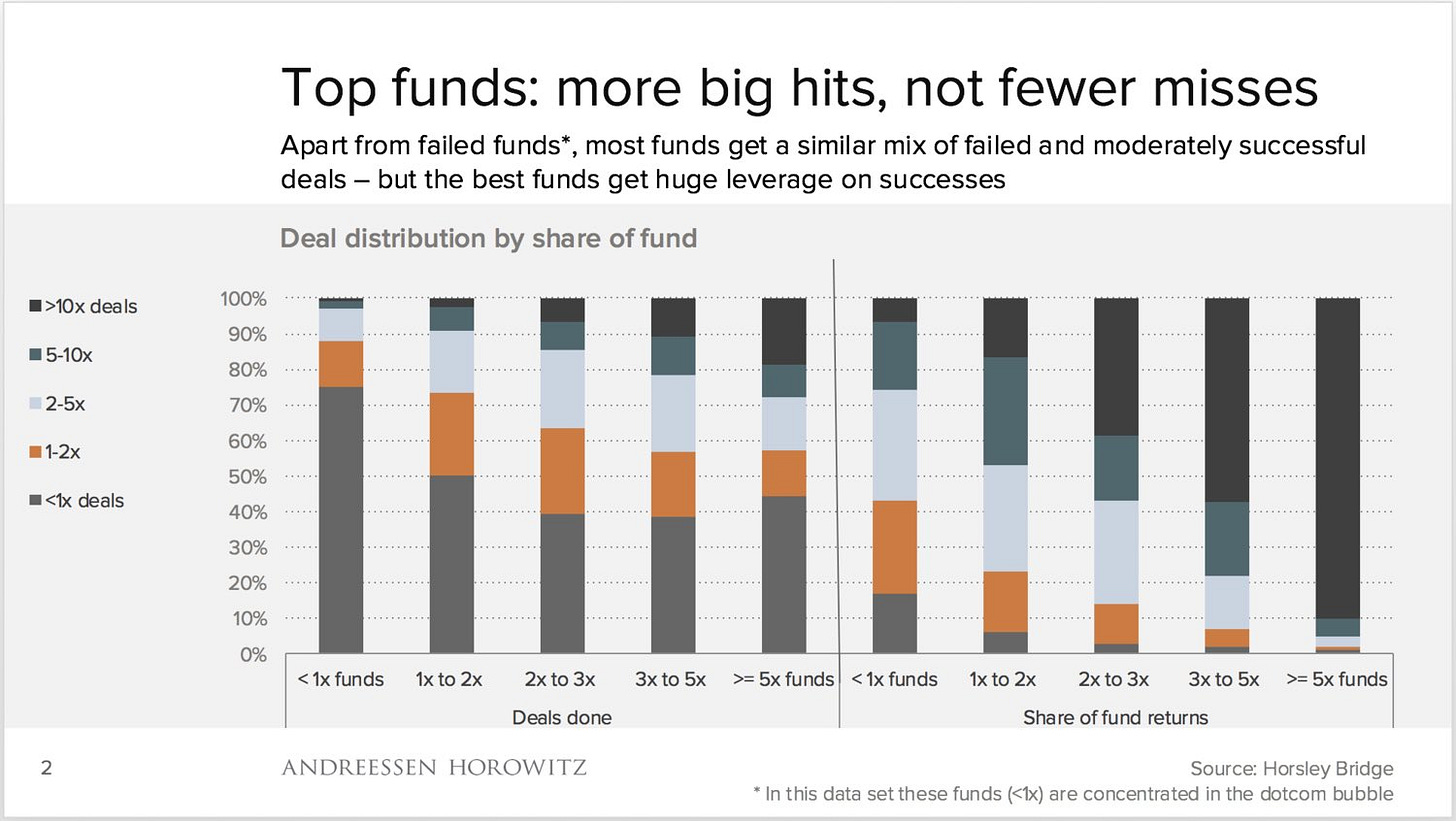

A quintessential example is Venture Capital. Most VCs, despite their research, do not bank on a single start-up to become successful. They recognize that it is highly improbable that the start-up they have put money into will be successful. Consequently, they pour hundreds of thousands of dollars into many options, essentially bleeding money. However, one of the many start-ups they have invested in becomes successful enough and makes sufficient profits to offset any losses incurred along the way. Diversification not only reduces the exposure to risk but also increases the odds of success. It's wise to avoid putting all of your eggs in one basket, as the proverb advises.

Warren Buffett once said he’s owned 400 to 500 stocks during his life and made most of his money on 10 of them. Charlie Munger followed up: “If you remove just a few of Berkshire’s top investments, its long-term track record is pretty average.”

The S&P 500 rose 22% in 2017. But a quarter of that return came from 5 companies – Amazon, Apple, Facebook, Boeing, and Microsoft. Ten companies made up 35% of the return.

This ties neatly with the Pareto Principle i.e., 80% of outcomes are due to 20% of causes and Surface Area of Luck. Interesting side note, the term “Tails” in Tail Events comes from the graphical representation of the Pareto Principle.

What this implies is that you do not have to depend on an unpredictable event or Black Swans in order to be successful. This is one of the core principles that drives Options Trading where traders bet both ways. Thus, no matter where the markets move, they still pocket a significant portion of profits while maintaining minimal losses.

This is also why huge companies regularly experiment with novel ideas or strategies. Take Amazon’s Fire Phone for instance. The company tried experimenting by trying to dip its feet into the waters of the mobile phone industry only to become a disaster. AWS (Amazon Web Services), which today accounts for the majority of Amazon's profit, was one of these experiments.

Amazon’s Total Revenue in 2021 = $469.8B

Amazon’s Total Operating Cost = $444.9B

Amazon's Total Operating Profit = $24.8B

$18.5B of these profits were made by AWS.

When asked about the failure of Fire Phone, Jeff Bezos had this to say:

“If you think that’s a big failure, we’re working on much bigger failures right now — and I am not kidding. Some of them are going to make the Fire Phone look like a tiny little blip.”

When we watch a comedy special by our favorite comedian, it is a product of a series of Tails. How so? Before recording the final show, comedians test out their jokes in numerous small clubs. They notice their audience’s reaction if they find it funny or not, and which jokes land perfectly and which ones don’t. In the end, what you and I get to watch are the tails of jokes only.

Huge media giants like Netflix operate with the same underlying framework. The company experiments with multiple new projects and the ones that become popular drive enough profits for all the bad shows that bleed money.

The key takeaway here is to experiment a lot and fail quicker. However, not every option is worth exploring. We need to pick and choose our battles wisely. We can either sit and watch Netflix after getting home or use that time to invest in our side projects that might one day yield huge returns. It is wise to invest in as many options as possible that are low-cost and high-yield potential. “You can’t, for one minute, feel bad about the Fire Phone. Promise me you won’t lose a minute of sleep,” Bezos told Ian Freed, a key leader in the Fire Phone’s development, according to The New Yorker. Remember this the next time you are scared of trying something new and failing.